Maintaining good oral health is crucial for your overall well-being, yet dental care can be costly without insurance. According to the National Association of Dental Plans, about 66% of Americans have some form of dental benefits. If you’re among the 34% without coverage, you might be asking yourself how to secure dental insurance.

In this engaging guide, we’ll walk you through everything you need to know about obtaining dental insurance in 2024. From understanding the various types of plans to comparing costs and coverage, you’ll gain the insights necessary to make informed decisions about protecting your smile.

Why Dental Insurance Matters

Dental insurance plays a crucial role in maintaining oral health and overall well-being. Here’s why it matters:

Financial Protection

Dental insurance provides significant financial benefits that make dental care more affordable and accessible. By covering a substantial portion of treatment costs, insurance helps reduce out-of-pocket expenses for many procedures. For example, many plans cover preventive services like check-ups, cleanings, and X-rays at 100%, encouraging regular dental visits. This coverage can lead to substantial savings, as without insurance, you’d be responsible for the full cost of your dental care.

Moreover, dental insurance often includes network discounts, where insurers negotiate lower fees with in-network dentists. This can provide additional savings, making it easier for people to seek necessary treatments and reducing the likelihood of skipping needed care due to cost concerns.

Improved Oral Health

Dental insurance promotes better oral health by encouraging regular check-ups and early detection of potential issues. People with dental insurance are almost twice as likely to get preventive care compared to those without it. These routine dental visits allow for early identification of problems, helping avoid more costly and complex procedures in the future.

Regular dental care can also help prevent more serious health issues. During routine exams, dentists can potentially detect signs of over 120 diseases, including heart disease and diabetes. This early detection capability underscores the importance of dental insurance in maintaining not just oral health, but overall health as well.

Overall Health Benefits

The connection between dental health and overall health is well-established. Poor oral health has been associated with increased risks of various systemic conditions. For instance, gum disease has been linked to serious health issues such as heart disease, stroke, dementia, rheumatoid arthritis, and diabetes.

By making dental care more accessible and affordable, insurance helps ensure that you and your family maintain healthy smiles and bodies. Regular dental visits facilitated by insurance coverage can contribute to better health outcomes and potentially lower overall healthcare costs in the long term.

Additional Advantages

Dental insurance offers several other benefits that enhance its value:

- Time-Saving Tools: Many insurance companies provide resources to help find dentists, estimate costs, and manage plans easily.

- Emergency Coverage: Dental insurance often covers urgent dental care, ensuring prompt treatment without financial worry.

- Workplace Benefits: For employers, offering dental insurance can reduce absenteeism and help attract and retain talent.

Cost-Effectiveness in 2025

As of 2025, dental insurance continues to be a cost-effective investment for many individuals and families. While premiums vary based on factors such as location and plan type, the potential savings on dental procedures often outweigh the cost of insurance. For example, a family of four making two preventive visits each and having a cavity filled over the course of a year can save significantly with insurance compared to paying out-of-pocket.

It’s important to note that dental benefits in Medicare Advantage plans have become increasingly prevalent, with 98% of plans offering some form of dental coverage in 2024. This trend is expected to continue through 2025, making dental care more accessible for seniors.

Types of Dental Insurance Plans

When exploring dental insurance options, understanding the various plan types is crucial for making an informed decision. Here’s an overview of the most common dental insurance plans available in 2025:

Dental Preferred Provider Organizations (DPPOs)

DPPOs remain the most prevalent type of dental insurance, accounting for 82% of all dental policies in the United States. These plans offer a network of dentists to choose from, providing flexibility in selecting a preferred provider.

Key features of DPPOs:

- Flexibility to choose from a network of dentists

- No requirement for a primary dentist or referrals

- Coverage for preventative care

- Potential for lower out-of-pocket costs within the network

Considerations:

- Out-of-network care can be more expensive

- Premiums may be higher compared to other plan types

- Limited coverage for out-of-network providers

The national average cost of dental PPO coverage ranges from $350 to $500 per year. For more information on DPPOs, visit the Delta Dental website.

Dental Health Maintenance Organizations (DHMOs)

DHMOs offer lower-cost coverage with a focus on preventive care. These plans typically cover cleanings, periodic oral evaluations, x-rays, and sealants.

Key features of DHMOs:

- Lower premiums compared to PPOs

- No deductibles to meet before coverage begins

- Typically no long waiting periods for restorative care

- Predetermined rates for dental services

Considerations:

- Must use in-network dentists for coverage

- Require selection of a primary dentist

- Referrals needed for specialist visits

- Smaller provider networks compared to PPOs

Learn more about DHMOs on the Cigna Healthcare website.

Dental Indemnity Plans

Also known as traditional plans, dental indemnity plans offer maximum flexibility in choosing dental providers.

Key features of Dental Indemnity Plans:

- No network restrictions

- Freedom to see any dentist

- No primary dentist or referral requirements

Considerations:

- Higher costs compared to other plan types

- Typically involve a deductible and coinsurance

- Average cost ranges from $400 to $700 per year

For more details on dental indemnity plans, visit the American Dental Association website.

Dental Discount Plans

While not traditional insurance, dental discount plans provide an alternative option for dental care savings.

Key features of Dental Discount Plans:

- Lower premiums than traditional insurance

- No annual spending limits, deductibles, or copays

- Immediate access to discounts

- Average savings of 50% on dental care

Considerations:

- Must use participating dentists to receive discounts

- Not insurance, but a membership program offering reduced fees

Explore dental discount plan options on the DentalPlans.com website.

Key Factors in Choosing Dental Insurance

When selecting dental insurance, several crucial factors can impact your coverage and out-of-pocket expenses. Understanding these elements will help you choose a plan that aligns with your oral health needs and financial situation.

Coverage Tiers

Dental plans typically categorize services into three distinct levels:

- Preventive Services: Most plans cover 100% of routine cleanings, exams, and X-rays. These services form the foundation of good oral health and are essential for early detection of potential issues.

- Basic Services: This tier usually includes fillings, extractions, and root canals. Plans generally cover 70-80% of these costs, leaving you responsible for the remainder.

- Major Services: More complex procedures like crowns, bridges, and dentures fall into this category. Expect coverage around 50% for these expenses, which can be significant without insurance.

Understanding these tiers helps you anticipate potential out-of-pocket costs and choose a plan that aligns with your expected dental needs.

Network Considerations

The type of provider network can significantly impact your dental care costs and options:

- Preferred Provider Organization (PPO): These plans offer flexibility, allowing you to visit any dentist. However, you’ll receive the highest benefits when choosing an in-network provider. PPOs are ideal if you have a preferred dentist or want more options.

- Dental Health Maintenance Organization (DHMO): DHMOs require you to select a primary care dentist and obtain referrals for specialists. While they often have lower premiums, they offer less flexibility in provider choice.

Before enrolling, verify your preferred dentist’s participation in the plan’s network to maximize your benefits and minimize unexpected costs.

Waiting Periods and Annual Maximums

Many dental insurance plans impose waiting periods for certain services, particularly major procedures. If you anticipate needing extensive work soon, prioritize plans with minimal or no waiting periods to avoid delays in necessary treatments.

Most dental plans cap their annual payouts, typically between $1,000 and $2,500. If you expect to need costly procedures, consider plans with higher annual limits to ensure adequate coverage for your needs.

Cost Factors: Premiums, Deductibles, and Copayments

When evaluating dental insurance options, consider the overall financial impact:

- Premiums: The recurring fee you pay for coverage, usually monthly or annually.

- Deductibles: The amount you must pay out-of-pocket before insurance coverage begins.

- Copayments: Fixed amounts you pay for specific services at the time of treatment.

Lower deductibles often correspond with higher premiums. Assess your anticipated dental needs to determine which cost structure is most beneficial for your situation.

Orthodontic Coverage

If you or a family member might need braces or other orthodontic treatments, ensure your chosen plan includes this coverage. Orthodontic benefits often have lifetime limits rather than annual maximums, so carefully review these terms if orthodontic care is a priority.

| Feature | PPO | DHMO |

|---|---|---|

| Provider Choice | More flexibility | Limited to network |

| Out-of-Network Coverage | Available | Not typically covered |

| Premiums | Generally higher | Usually lower |

| Referrals | Not required | May be required |

Additional Considerations

- Pre-existing Conditions: Some plans may exclude or limit coverage for pre-existing dental issues. Review policy details carefully if you have ongoing dental concerns.

- Specialized Coverage: Verify coverage for specific needs like dental implants or periodontal treatments if these are relevant to your oral health situation.

- Insurer Reputation: Research the insurance provider’s reputation and customer reviews to ensure reliable service and claim processing.

By carefully weighing these factors and comparing multiple plans, you can select dental insurance that offers the right balance of coverage and affordability for your unique needs.

How to Obtain Dental Insurance in 2025

Securing dental insurance is crucial for maintaining oral health and managing dental care costs. Here’s a comprehensive guide on obtaining dental coverage through various avenues:

Employer-Sponsored Plans

Many employers offer dental insurance as part of their benefits package, often the most cost-effective option for employees. These plans typically feature:

- Lower premiums due to group rates

- Potential employer contributions to premiums

- Convenient payroll deductions

To enroll in an employer-sponsored plan:

- Contact your company’s HR department to learn about available dental plans.

- Review options during the annual open enrollment period, which usually occurs 30-60 days before the plan’s effective date.

- Consider factors such as coverage limits, deductibles, and in-network providers when selecting a plan.

Individual Plans

If employer-sponsored coverage isn’t available, you can purchase an individual dental plan:

Through the Health Insurance Marketplace

- Visit (https://www.healthcare.gov/) during the open enrollment period, which typically runs from November 1 to January 15 for coverage starting the following year.

- Choose between a health plan that includes dental coverage or a standalone dental plan.

Directly from Insurance Providers

- Research and compare plans from various insurers.

- Obtain quotes from multiple providers to find the best value.

- Ensure the insurer is licensed to sell dental insurance in your state.

When evaluating individual plans, consider:

- Annual coverage limits

- Coinsurance terms

- Deductibles

- Premiums

- Waiting periods

Government Programs

Depending on age, income, and circumstances, you may qualify for government-sponsored dental coverage:

Medicaid

- Offers optional dental services for adults 21 and older

- Provides required dental services for most Medicaid-eligible individuals under 21 through the Early and Periodic Screening, Diagnostic and Treatment (EPSDT) benefit

Children’s Health Insurance Program (CHIP)

- Provides coverage for children from low-income families

To check eligibility, contact your state’s Medicaid office or visit (https://www.healthcare.gov/) for more information.

Dental Savings Plans

As an alternative to traditional insurance, dental savings plans offer:

- Potential savings for those needing only basic dental care

- Discounted rates on dental services for an annual membership fee

- No waiting periods, allowing immediate access to services

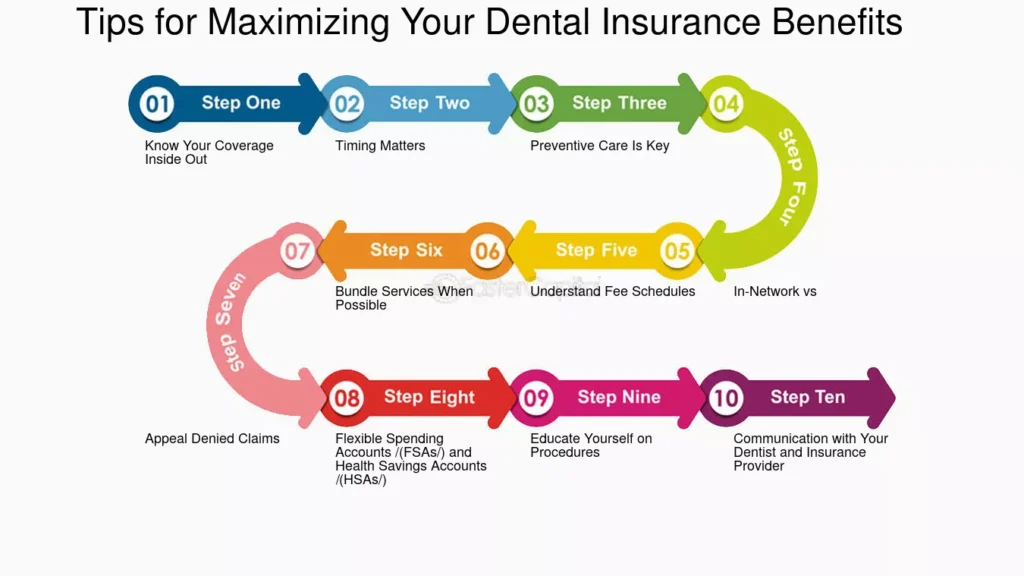

Tips for Maximizing Your Dental Insurance Benefits

Prioritize Preventive Care

Take full advantage of covered preventive services, such as regular check-ups and cleanings. Most dental plans typically cover these services at 100%, making them an essential part of maintaining optimal oral health. By scheduling these appointments early, you can catch potential issues before they become more serious and costly. According to the National Association of Dental Plans, only 2.8% of people with PPO dental plan participants reached or exceeded their plans’ annual maximum, indicating a significant opportunity for better utilization. Regular preventive care not only helps maintain your oral health but also allows you to make the most of your dental benefits.

Stay In-Network

Choose dentists who are in-network with your insurance plan to minimize out-of-pocket costs. In-network providers have pre-negotiated rates with your insurer, resulting in lower expenses for you. When selecting a dentist, verify their network status with your insurance provider to ensure you’re maximizing your benefits. The American Dental Association (ADA) provides guidance on coordination of benefits, which can be particularly useful if you have coverage under multiple plans. By understanding how your benefits work across different providers, you can optimize your coverage and reduce overall costs.

Plan Ahead for Major Procedures

If you anticipate needing major dental work, strategize with your dentist to make the most of your benefits. Consider the following approach:

- Discuss treatment options with your dentist to prioritize necessary procedures.

- Schedule treatments strategically, possibly starting towards the end of the year to utilize current and next year’s benefits.

- Consider phasing treatments to align with your insurance coverage and maximize your annual benefits.

Many dental plans operate on a calendar year basis, with benefits expiring on December 31st. By planning ahead, you can ensure that you don’t leave any unused benefits on the table. The ADA recommends verifying your plan’s specific deadlines and coverage limits to optimize your treatment schedule.

Understand Your Plan’s Limitations

Familiarize yourself with your dental insurance policy details to make informed decisions about your care. Key aspects to review include:

- Covered services, annual maximums, and deductibles

- Waiting periods for certain treatments

- Orthodontic coverage, if applicable

Understanding these details can help you plan your dental care more effectively and avoid unexpected costs. The National Association of Dental Plans reports that about 63% of dental PPOs have a maximum annual benefit of $1,500 or more. By knowing your plan’s specifics, you can work with your dentist to prioritize treatments and maximize your coverage throughout the year.

Use Your Benefits Before They Expire

To make the most of your dental insurance, consider these strategies:

- Schedule appointments early to avoid the year-end rush.

- Utilize any remaining benefits before they reset, as unused benefits typically don’t roll over.

- If you have a Flexible Spending Account (FSA) or Health Savings Account (HSA), coordinate dental expenses with these funds before they expire.

By following these tips and staying proactive about your dental care, you can ensure you’re getting the most value from your dental insurance while maintaining optimal oral health. Remember to consult with your dentist and insurance provider for personalized advice on maximizing your specific plan benefits.

Conclusion

Investing in dental insurance can significantly ease the financial burden of maintaining a healthy smile. By understanding various types of plans and considering your unique needs, you can find the right solution for you and your family.

Remember that preventive care is crucial for long-term oral health—prioritize regular check-ups and cleanings. With the right dental insurance plan and a commitment to good oral hygiene habits, you’ll be well on your way to a lifetime of healthy teeth and gums!