The global alginate industry stands at a pivotal moment, with unprecedented growth reshaping market dynamics and supplier relationships. As we navigate through 2024, the market demonstrates robust expansion, valued at USD 902.26 million and projected to reach USD 1,631.05 million by 2034, marking a steady CAGR of 5.53%.

Market Overview and Dynamics

Current Market Landscape: The alginate market has undergone significant evolution, propelled by its expanding applications in the pharmaceutical, food, and industrial sectors. This natural polymer, primarily sourced from brown seaweed, is now essential across various industries due to its unique properties and versatility. As of 2024, the global alginate market is valued at approximately USD 442.59 million and is projected to reach USD 605.71 million by 2032, growing at a CAGR of about 4% during this period.

Regional Market Distribution: The Asia Pacific region leads the global alginate market, accounting for over 38% of the total share. This dominance is attributed to:

- Extensive cultivation of brown seaweed along coastal areas

- Advanced processing facilities located in China and Japan

- Emerging pharmaceutical manufacturing hubs

- A robust infrastructure supporting the food industry

In comparison, Europe holds the position of the second-largest market, excelling in:

- Production of pharmaceutical-grade alginate

- Innovative research and development initiatives

- Sustainable harvesting practices

- High-quality control standards

Additionally, growing consumer demand for natural ingredients in food products further drives market expansion across all regions.

Industry Leaders and Market Share

Top Global Suppliers

| Company Name | Market Share | Primary Specialization |

|---|---|---|

| KIMICA Corporation | 18% | Pharmaceutical Grade |

| Cargill Inc. | 16% | Food Applications |

| DuPont de Nemours | 15% | Technical Solutions |

| FMC Corporation | 14% | Industrial Grade |

| Dow Chemical Company | 12% | Specialty Products |

Company Profiles and Strengths

KIMICA Corporation leads the market with an 18% share, focusing primarily on pharmaceutical-grade products. Its success is attributed to:

- Vertically integrated production facilities that enhance efficiency.

- A strategic presence in key Asian markets, ensuring robust distribution.

- Strong R&D capabilities that foster new developments.

- Commitment to sustainable harvesting practices that align with environmental standards.

Cargill Inc., holding a 16% market share, excels in food applications due to its:

- Extensive global distribution network, facilitating widespread reach.

- Rigorous quality assurance programs ensuring product reliability.

- Continuous innovation in food applications, addressing evolving consumer needs.

- A strong customer-centric approach that fosters loyalty.

DuPont de Nemours, with a 15% market share, offers unique advantages in technical solutions, including:

- Extensive technical expertise that sets industry standards.

- A comprehensive patent portfolio, safeguarding its innovations.

- A network of global research facilities promoting collaboration.

- The ability to develop tailored custom solutions for diverse client needs.

FMC Corporation has recently reported strong revenue growth, reflecting its focus on innovation within the industrial sector. With a diverse product range aimed at various industries, FMC’s commitment to sustainability enhances its competitive edge.

Dow Chemical Company remains a key player with its focus on specialty products and sustainable practices. Its strong customer relationships and technical expertise allow it to adapt quickly to market demands while maintaining high standards of quality.

Product Categories and Applications

Pharmaceutical Grade Alginates

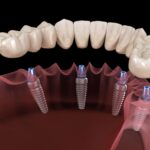

The pharmaceutical sector is the fastest-growing segment for alginates, driven by their versatile applications. These include controlled release drug delivery systems, which enhance bioavailability and improve therapeutic outcomes by allowing sustained medication dosing. Alginates are also integral to advanced wound care products, promoting healing by maintaining a moist environment that reduces infection risk and absorbs excess exudate. Furthermore, they are essential in dental impression materials, widely used for creating accurate molds of patients’ teeth and oral tissues, and in cell encapsulation technologies, which are crucial for targeted drug delivery and tissue engineering applications.

Food Grade Alginates

In the food industry, alginates play a pivotal role in enhancing product quality and texture. They are widely used for modifying textures in processed foods and stabilizing ice cream and dairy products, ensuring consistency and preventing separation. Moreover, alginates support emulsion systems, which help maintain the stability of dressings and sauces by preventing oil and water separation, and are vital in plant-based meat alternatives, where they replicate traditional meat textures effectively. Recent studies have also highlighted their role as dietary fibers that can aid in weight management by slowing fat absorption and improving gut health.

Industrial Applications

Technical grade alginates cater to diverse industrial needs, offering unique functional benefits. They are crucial in textile printing and dyeing for uniform color application, enhancing the aesthetic appeal of fabrics. In addition, alginates are used in paper coating to improve surface properties, ensuring better print quality and durability. Their application extends to welding rod coatings, where they provide stability during high-temperature processes, and in ceramic processing, where they enhance material performance through improved binding properties. Furthermore, alginates are increasingly utilized in innovative food packaging solutions to extend shelf life by creating moisture-retentive barriers.

Market Trends and Innovation

Emerging technologies are transforming industries through significant advancements that improve efficiency and sustainability. Key innovations include bioprinting applications utilizing peptide-modified alginates, which enhance cell-material interactions for medical purposes, and nano-encapsulation techniques that boost the stability and bioavailability of bioactive compounds in nutraceuticals. Additionally, sustainable extraction methods are fostering eco-friendly practices by minimizing environmental impact. Furthermore, smart packaging solutions are enhancing product safety while engaging consumers through interactive features like QR codes that provide detailed product information.

Simultaneously, leading suppliers are prioritizing sustainability initiatives to meet consumer demands for environmentally responsible practices. These initiatives include responsible harvesting programs that conserve natural resources, strategies for carbon footprint reduction aimed at mitigating climate change, and innovative approaches to waste minimization that enhance operational efficiency. The shift towards biodegradable packaging solutions reflects a strong commitment to environmental stewardship, ensuring that products not only meet consumer needs but also protect our planet.

Quality Standards and Certification

To ensure the highest product quality and safety, major suppliers adhere to globally recognized standards. These include ISO 9001:2015 certification, which enhances operational efficiency and customer satisfaction by ensuring consistent product quality; GMP compliance, which mandates that manufacturing processes meet rigorous safety and quality requirements; HACCP certification, a critical framework for identifying and managing food safety risks; and FDA registration, which confirms that products comply with regulatory standards for safety and effectiveness.

Quality Parameters

Products are evaluated against stringent quality benchmarks that are essential for maintaining high standards:

- Viscosity: Standard range of 300-400 cP, with premium grades exceeding 500 cP, crucial for ensuring optimal performance in various applications.

- Gel Strength: Standard range of 500-600 g/cm², with premium grades surpassing 700 g/cm², indicating superior product integrity.

- Particle Size: Standard range of 100-150 mesh, with premium grades below 100 mesh, vital for achieving desired product characteristics.

- Moisture Content: Standard limit of <15%, with premium grades maintaining <12%, essential for product longevity.

These certifications not only ensure compliance but also significantly enhance overall product quality and safety across diverse industries. By adhering to these standards, suppliers demonstrate their commitment to excellence, ultimately leading to improved customer trust and satisfaction.

Supply Chain and Distribution

The global supply network thrives on strategic sourcing partnerships, regional distribution centers, and quality control checkpoints. These elements, combined with advanced inventory management systems, ensure seamless operations and adaptability to market demands. In 2024, businesses are increasingly adopting sustainable practices, such as optimizing routes for fuel efficiency and utilizing eco-friendly packaging materials, which enhance both efficiency and corporate responsibility.

Building on these foundational elements, effective logistics management further optimizes distribution processes through temperature-controlled transportation, real-time tracking systems, and just-in-time delivery. Additionally, regional warehousing plays a pivotal role in reducing lead times and optimizing storage solutions. As companies leverage technology like data analytics for demand forecasting, they can enhance responsiveness and minimize disruptions in their supply chains. Together, these strategies create a resilient framework that not only meets customer expectations but also positions businesses competitively in a rapidly evolving market.

Future Market Outlook

Growth Projections

The market is expected to maintain strong momentum driven by several key factors:

- Increasing pharmaceutical applications, particularly in personalized medicine and chronic disease management, as global prescription drug sales are projected to reach $1.7 trillion by 2030.

- Growing demand for natural ingredients, with consumer preferences shifting towards sustainable and organic products. Studies show that 73% of consumers are willing to pay more for personal care items containing natural ingredients.

- Expansion in emerging markets, especially in Asia-Pacific, where healthcare investments are rising due to a growing middle class and improved healthcare infrastructure. This region is anticipated to contribute significantly to overall market growth, with a projected increase of 4.6% in pharmaceutical output in 2024.

- Technical innovations, such as advancements in artificial intelligence (AI) and biotechnology, are revolutionizing drug discovery and development processes. The AI market in pharmaceuticals is expected to grow at a CAGR of 29.3%, reaching over $11 billion by 2032, significantly enhancing R&D efficiency.

Investment and Development

Key areas of focus for companies looking to capitalize on these trends include:

- Research and development expansion to innovate new products that meet evolving consumer needs and regulatory standards.

- Sustainable production methods that align with environmental regulations and consumer expectations for ethical sourcing, ensuring long-term viability.

- Market penetration strategies tailored to local needs in emerging markets, enhancing access to essential medicines and addressing prevalent health issues.

- Product diversification to cater to the increasing demand for both pharmaceutical and natural ingredient-based solutions, allowing companies to adapt to changing market dynamics.

This comprehensive approach not only positions businesses for long-term success but also addresses the evolving landscape of consumer preferences and technological advancements in the pharmaceutical industry.

Price Trends and Economic Factors

Pricing Structure

| Grade Type | Price Range (USD/kg) | Volume Discount |

|---|---|---|

| Pharmaceutical | 12-15 | 10-15% |

| Food Grade | 8-11 | 8-12% |

| Technical Grade | 5-7 | 5-10% |

Economic Influences

Market prices are shaped by several factors, including:

- Raw material availability: Fluctuations in supply can significantly impact costs.

- Energy costs: Rising energy prices often lead to higher production expenses.

- Transportation expenses: Logistics and shipping fees contribute to overall pricing.

- Currency fluctuations: Exchange rate variations affect international trade.

Recent data indicates that average drug prices increased by approximately 5% in the first half of 2024, influenced by inflation, supply chain disruptions, and the introduction of new high-cost medications. Furthermore, overall prescription drug spending is projected to rise by 10% to 12% in 2024, reflecting ongoing economic pressures and regulatory changes such as the Inflation Reduction Act, which aims to control escalating costs but has had mixed results on market dynamics.

Regulatory Environment

Suppliers must comply with global standards such as:

- FDA regulations

- EU food safety standards

- ISO quality management systems

- Environmental protection guidelines

Notable regulatory updates for 2024 include FDA guidance on lead levels in baby food and new labeling requirements for plant-based alternatives, which reflect a growing emphasis on consumer safety and transparency.

Regional Requirements

Specific regional considerations include:

- China: New food safety laws emphasize stricter quality controls.

- EU: REACH regulations focus on chemical safety.

- US: FDA’s FSMA compliance ensures food safety modernization.

- Japan: Pharmaceutical standards demand rigorous adherence to quality.

Geopolitical tensions are also influencing supply chains, leading to increased costs for raw materials and transportation. For example, the resurgence of avian influenza has raised concerns about poultry prices, potentially impacting food grade pricing in the coming year.

Conclusion

The alginate market continues to evolve, driven by innovation, sustainability, and expanding applications. Leading suppliers maintain their positions through strategic investments in quality, research, and sustainable practices. As we move forward, the industry’s growth trajectory suggests continued expansion and development of new applications, particularly in pharmaceutical and sustainable products sectors.